Fannie Mae's LTV Ratio Update: Boosting Access to Credit and Affordable Housing

Original Source: saleztrax.com

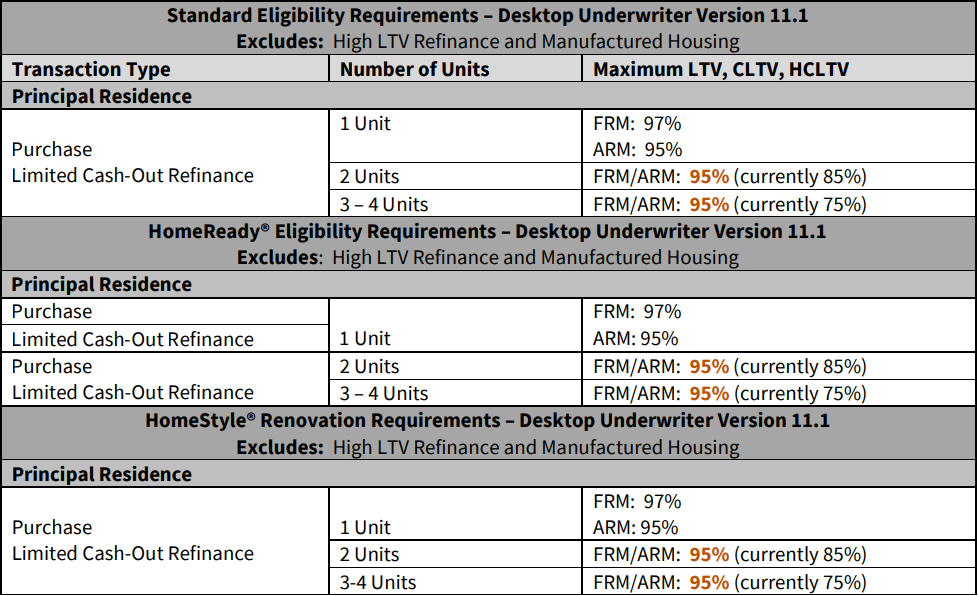

Fannie Mae's recent adjustment to its LTV (Loan-to-Value) ratios, effective from November 18, 2023, signifies a proactive response to the evolving needs of the housing market. In this blog post, we'll delve into the details of these changes, particularly focusing on how Desktop Underwriter Version 11.1 is shaping the landscape for two- to four-unit properties, principal residences, and various transaction types.

To address the critical need for increased credit access and support for affordable rental housing, Fannie Mae adjusted the maximum allowable LTV, CLTV, and HCLTV ratios for specific transaction types. Notably, the maximum ratios for two- to four-unit properties, principal residences, and select transactions were increased to 95%.

Transaction Types Affected:

- Principal Residence Purchase

- Limited Cash-Out Refinance

Maximum LTV Ratios:

Exclusions:

This change does not apply to high-balance mortgage loans and loans that are manually underwritten.

For Further Reference:

Lenders can find additional details in the Fannie Mae Selling Guide here. Stay informed about these updates, which took effect last week, and explore the broader implications for the mortgage industry.

Subscribe to our blog and stay up to date about changes in the market that effect buyers. Or contact us to learn more about mortgage processing services.